Creating Fast and Error-Free Client Request Handling for EU Insurance Company

A leading insurance company approached IBA Group. Their company offers many types of risk protection, including medical, auto, cargo, mortgage/homeowner’s insurance, and property protection coverage. The Europe-based insurer was hoping to optimize its processing of client requests.

We helped them find a solution that would streamline their procedures and automate client request processing, reduce their error rate, and cut down on client request processing time.

Our solution used Camunda platform and EasyRPA to optimize client request processing, significantly reducing the error rates and processing times.

CLIENT

A leading insurance company that offers a plethora of services, including medical, car, cargo, mortgage, and property protection insurance

INDUSTRY

Insurance

LOCATION

Europe (DACH region)

Goal

Develop and implement a client request processing solution aimed to streamline and automate client request processing, enhancing its efficiency and accuracy, thereby strengthening the company’s competitive position in the insurance market.

Background

The insurance company was grappling with inefficient client request processing that averaged 7-8 hours and was often riddled with manual data entry errors. Data discrepancies led to inaccuracies in customer information and the subsequent provision of erroneous insurance offers. In a market saturated with competition, this posed significant challenges, deterring potential clients.

Challenges

- Long processing time for client requests

- Frequent data entry errors leading to incorrect insurance offers

- Loss of potential clients, weakening the company’s market position

Key Objectives

- Streamline and automate client request processing

- Minimize manual intervention

- Ensure data accuracy

Project Team

- Delivery Manager

- Camunda Consultant

- Business Analyst

- Camunda/Java Developer

- AI Developer

- Data Analyst

- QA Engineer

Project Duration

Three months

Solution: Project Stages and Implementation

Like many of our projects, we took the discovery and implementation process through several steps to ensure that IBA Group and the insurance company were on the same page.

Initial Analysis: IBA Group conducted a detailed review of the existing business processes at the insurance company so we could fully understand the functionality.

Bottleneck Identification: In a follow-up to the initial analysis, IBA Group identified the weak points in the processes and systems that were causing the slowdowns and delays in the client request processing.

Core Issues Analysis: The project team also analyzed the issues that arose from manual data entry errors and led to the issuance of unattractive offers to clients.

Technical Solution Selection: The project team based on the identified bottlenecks and re-issuance concerns selected Camunda to orchestrate all process activities and RPA to substitute manual tasks.

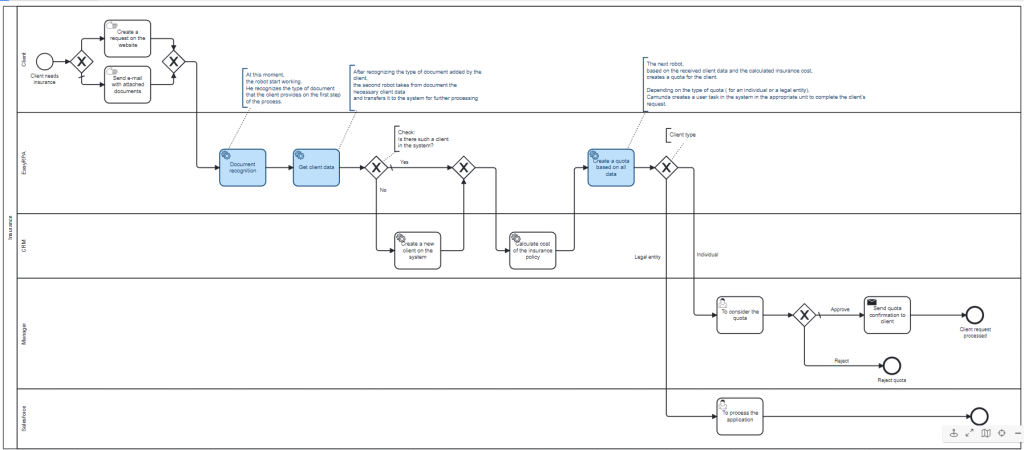

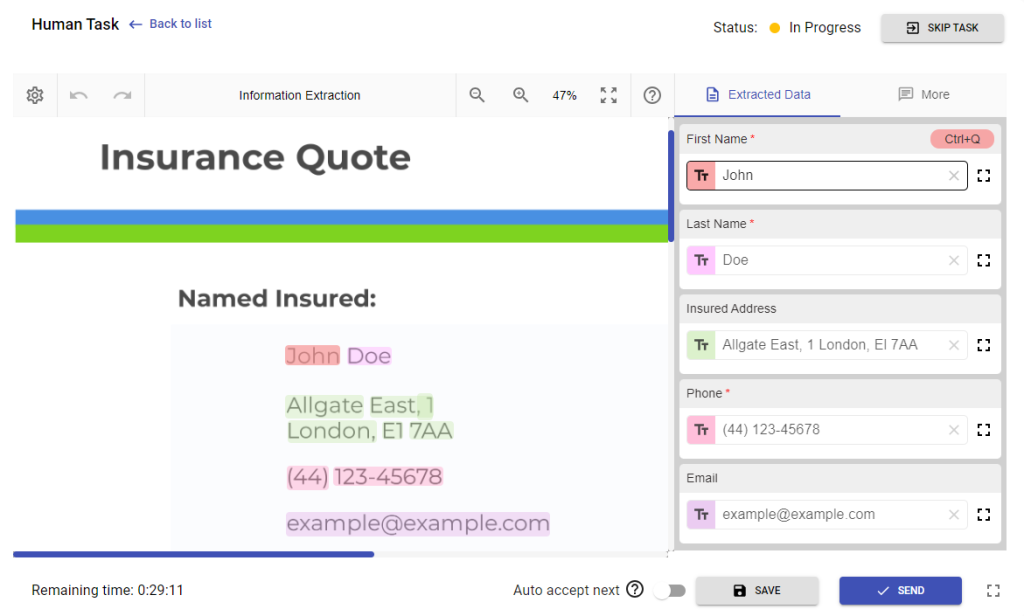

Automation using EasyRPA with AI module: 3 robots were implemented that has significantly expedited and enhanced the customer request processing procedure. They automatically processed the data, recognized, classified and generated the necessary documents in the system.

Process automation using Camunda: the team has created a new process using Camunda which orchestrates the work between humans, robots and other customer systems in an efficient way.

Integration with CRM: Camunda automatically transfers client data to CRM, where the new client is created or client data is verified. This has significantly reduced the risk of errors.

Integration with other client systems: Camunda calls existing quotes calculation module and module to create client documents. This reduced the client documents preparation and excluded human intervention.

Approval and notification steps: Camunda creates tasks for the managers in the tasklist for final quota approval and sends notification to the client about the decision on quota of insurance upon final approval.

Training and Demonstration: IBA Group conducted a workshop for the company following the implementation with a demo of the new application.

Solution Highlights

Ultimately, the solution met the needs of the client and was a successful choice. There were several highlights within the solution that IBA Group implemented:

Process automation with Camunda: Camunda allows process automation and different tasks orchestration reducing quotes preparation time and the level of the human intervention.

Integration: Wide range of Camunda connectors and APIs facilitate seamless integration between different systems. As a result, client data was synchronized with the CRM system, and EasyRPA robots are incorporated into the process without need of human intervention.

EasyRPA Automation: Incorporating three robotic processes improved and accelerated the client request processing mechanism. The deployed robots using the AI module streamlined data processing with automatic data recognition, classification, and document generation capabilities.

Process Conclusion: The entire process is complete once all stages are successfully executed and the client is duly informed about the outcome.

Benefits for the Customer

The solution presented several outstanding benefits for the insurance company, which they were able to experience right away.

- Faster application processing

- Personalized and appealing insurance quotes for customers

- Streamlined process with fewer forms to fill out and a hassle-free user experience

Results & Metrics

The measurable results of the project implementation speak for themselves. The Insurance company was extremely satisfied with the results, which included:

- The average processing time for an insurance application was slashed from several hours to just 20-30 minutes

- The implementation led to a 12% increase in signed insurance policies

- A whopping 87% of documents are now accurately recognized and classified

- The error rate plummeted by 80% because of automated data transfer

By focusing our solution on customer-centricity and integrating state-of-the-art technologies like Camunda and RPA, we were able to boost the profile of the insurance company. The company is now positioned as a premier choice in the market, with a reputation for providing swift and accurate service.

Lessons Learned in this Project

One of the best parts of any successful implementation is the ability to learn. We can often use similar solutions to assist customers in the future. Based on IBA Group’s research and experience from this project, we offer the following conclusions and recommendations for clients encountering comparable challenges.

Focus on Customer-Centric Solutions: Today’s clients value their time. Companies must immerse themselves in the customer’s perspective and ensure they provide services tailored to the needs of their target audience.

Quick Response to Inquiries: Clients expect speed and responsiveness. Potential customers want prompt answers to their questions. Aim to reduce waiting and processing times to meet clients’ desire for immediate feedback.

Business Process Automation: Leverage contemporary IT solutions and tools to automate business processes. Platforms like Camunda notably improve request processing efficiency and minimize errors.

Integration with EasyRPA: Robotic Process Automation (RPA) can dramatically lessen manual tasks and boost data processing precision. Think about weaving EasyRPA into your operational processes—how can automation help streamline your procedures?

Stay Up with the Latest Technologies: The service market is intensely competitive. Firms that keep pace with evolving trends and harness cutting-edge technologies position themselves at the forefront. Prioritize innovation to hold onto your market edge.

Staff Training: Ensure your team has the training, skills, and knowledge to navigate modern tech and automation systems.

Monitor Feedback: Regularly collecting client and staff feedback is crucial for refining business processes and tools.

In today’s dynamic insurance landscape, the emphasis is on swift, tailored services and integrating the latest technological advancements. To keep pace and stay competitive, it’s essential to prioritize customer-centric solutions, embrace automation, and continuously update staff skills and company systems.

At IBA Group, we have successfully navigated these challenges and are ready to guide you through your next transformation. Let’s work together to shape a future that benefits both your business and your clients.