Creating Fast and Error-Free Client Request Processing

Author: Alexei Bolotin

A leading Europe-based insurer approached us, aiming to optimize processing of client requests. This company offers many types of risk protection, including medical, auto, cargo, mortgage/homeowner’s insurance, and property protection coverage.

The insurer sought to find a solution that would streamline their procedures and automate client request processing, reduce their error rate, and cut down on client request processing time. We offered a solution that was based on the Camunda platform and included our EasyRPA platform to optimize client request processing, significantly reducing the error rates and processing times.

Goals

Our goal for this project was to develop and implement a client request processing solution. The solution needed to streamline and automate client request processing while enhancing the system’s efficiency and accuracy. The ultimate goal of this endeavor was to strengthen the company’s competitive position in the insurance market.

Background and Challenges

When the insurance company approached us, they were grappling with inefficient client request processing (i.e., insurance policy request processing). Many client requests took 7-8 hours to process, often riddled with manual data entry errors.

Data discrepancies led to inaccuracies in customer information. Ultimately, these errors led to loss, resulting in the provision of erroneous insurance offers to clients. In a market like insurance, saturated with heavy competition, inaccuracies pose significant challenges and deter potential clients.

Project Stages and Implementation

Like many of our projects, we took the discovery and implementation process through several steps to ensure that IBA Group and the insurance company were on the same page.

Initial Analysis: We conducted a detailed review of the existing business processes at the insurance company so we could fully understand the functionality.

Bottleneck Identification: In a follow-up to the initial analysis, we identified in the processes and systems the weak points that were causing the slowdowns and delays in the client request processing. Core Issues Analysis: The project team also analyzed the issues that arose from manual data entry errors and led to the issuance of unattractive offers to clients.

Technical Solution Selection: Based on the identified bottlenecks and re-issuance concerns, the project team selected Camunda to orchestrate all process activities and RPA to substitute manual tasks.

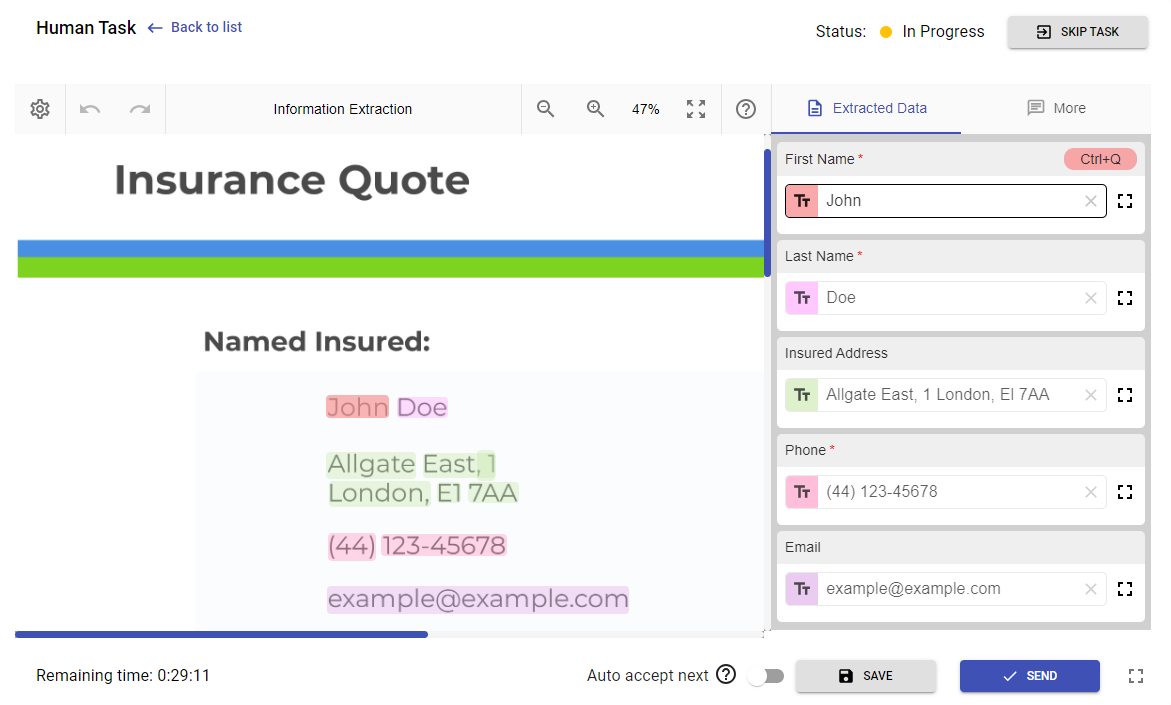

Automation Using EasyRPA with AI Module: We implemented three robots that significantly expedited and enhanced the customer request processing procedure. They automatically processed the data, and recognized, classified and generated the necessary documents in the system.

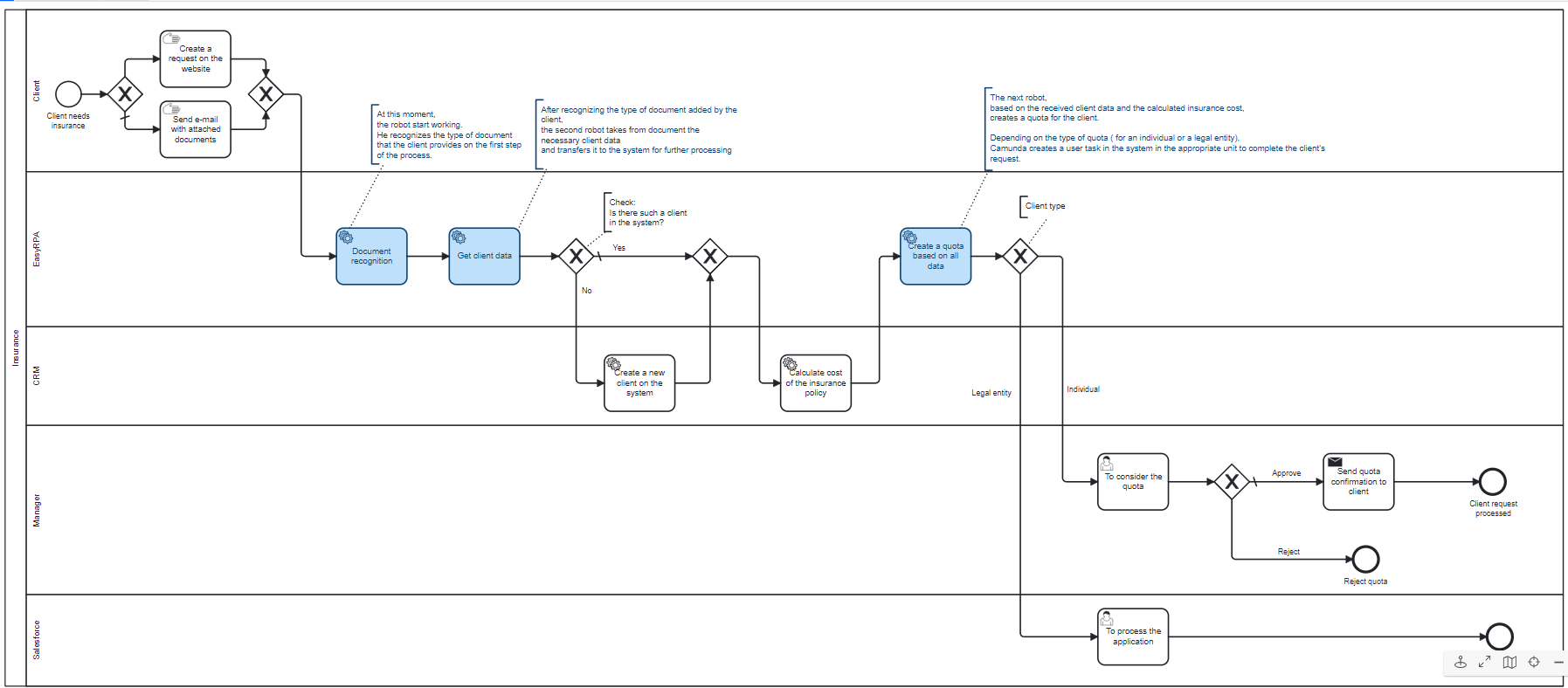

Process Automation Using Camunda: Our team has created a new process using Camunda that orchestrates the work between humans, robots, and other customer systems in an efficient way.

- Integration with CRM: Camunda automatically transfers client data to CRM, where the new client is created or client data is verified. This significantly reduces the risk of errors.

- Integration with other client systems: Camunda calls the existing quotes calculation module and the module that creates client documents. This reduces the client documents preparation time and excludes human intervention.

- Approval and Notification Steps: Camunda creates tasks for the managers in the tasklist for final quote approval and notifies the client about the decision on insurance quotes upon the final approval.

Training and Demonstration: On project completion, we conducted a workshop for our client with a demo of the new application.

Solution Highlights

Ultimately, our solution met the needs of the client and was a successful choice. I would like to single out several highlights within the solution we implemented.

- Process Automation with Camunda: Camunda allows for process automation and different tasks orchestration, resulting in the reduced quotes preparation time and level of the human intervention.

- Integration: A wide range of Camunda connectors and APIs facilitate seamless integration between different systems. As a result, client data is synchronized with the CRM system, and EasyRPA robots are incorporated into the process without the need of human intervention.

- EasyRPA Automation: Incorporating three robotic processes improved and accelerated the client request processing mechanism. The deployed robots that use an AI module streamlined data processing with automatic data recognition, classification, and document generation capabilities.

- Process Conclusion: The entire process is complete once all stages are successfully executed and the client is duly informed about the outcome.

Benefits for the Customer

The solution presented several outstanding benefits for the insurance company, which they were able to experience right away.

- Faster application processing

- Personalized and appealing insurance quotes for customers

- Streamlined process with fewer forms to fill out and a hassle-free user experience

Results & Metrics

The measurable results of the project implementation speak for themselves. The Insurance company was extremely satisfied with the results, which included:

- The average processing time for an insurance application slashed from several hours to just 20-30 minutes

- The implementation led to a 12% increase in signed insurance policies

- A whopping 87% of documents are now accurately recognized and classified

- The error rate plummeted by 80% because of the automated data transfer

By focusing our solution on customer-centricity and integrating state-of-the-art technologies like Camunda and RPA, we were able to boost the profile of the insurance company. The company is now positioned as a premier choice in the market, with a reputation for providing swift and accurate service.

Lessons Learned in this Project

One of the best parts of any successful implementation is the ability to learn. We can often use similar solutions to assist customers in the future. Based on IBA Group’s research and experience from this project, we offer the following conclusions and recommendations for clients encountering comparable challenges.

Focus on Customer-Centric Solutions: Today’s clients value their time. Companies must immerse themselves in the customer’s perspective and ensure they provide services tailored to the needs of their target audience.

Quick Response to Inquiries: Clients expect speed and responsiveness. Potential customers want prompt answers to their questions. Aim to reduce waiting and processing times to meet clients’ desire for immediate feedback.

Business Process Automation: Leverage contemporary IT solutions and tools to automate business processes. Platforms like Camunda notably improve request processing efficiency and minimize errors.

Integration with EasyRPA: Robotic Process Automation (RPA) can dramatically lessen manual tasks and boost data processing precision. Think about weaving EasyRPA into your operational processes—how can automation help streamline your procedures?

Staying Up with the Latest Technologies: The service market is intensely competitive. Firms that keep pace with evolving trends and harness cutting-edge technologies position themselves at the forefront. Prioritize innovation to hold onto your market edge.

Staff Training: Ensure your team has the training, skills, and knowledge to navigate modern tech and automation systems.

Monitoring Feedback: Regularly collecting client and staff feedback is crucial for refining business processes and tools.

In today’s dynamic insurance landscape, the emphasis is on swift, tailored services and integrating the latest technological advancements. To keep pace and stay competitive, it’s essential to prioritize customer-centric solutions, embrace automation, and continuously update staff skills and company systems.

At IBA Group, we have successfully navigated these challenges and are ready to guide you through your next transformation. Let’s work together to shape a future that benefits your business and your clients.